NO MONEY DOWN

100% FINANCING AVAILABLE

INSTANT DECISION ON LOANS UNDER $20,000

| Affordable Montly Plans | Quick & Easy Application | No Prepayment Penalties |

|---|---|---|

| Pay for your order over 12, 24 or 36 months | Get a decision in seconds with no obligation to buy. Checking your rate will not affect your credit score | Pay for your purchase with monthly payments and prepay at any time without penalty! |

| $1,000 to $100,00 | Instant Financing Decisions | Pay Off At Any Time |

| 100% Financing - No Money Down | No Obligation To Buy | Easy Monthly Payments |

| Use Funds For Entire Construction Project | Checking Your Rate Won't Affect Your Credit Score | No Prepayment Penalties |

| CLICK TO APPLY |

Swimming Pool Kit Financing FAQ

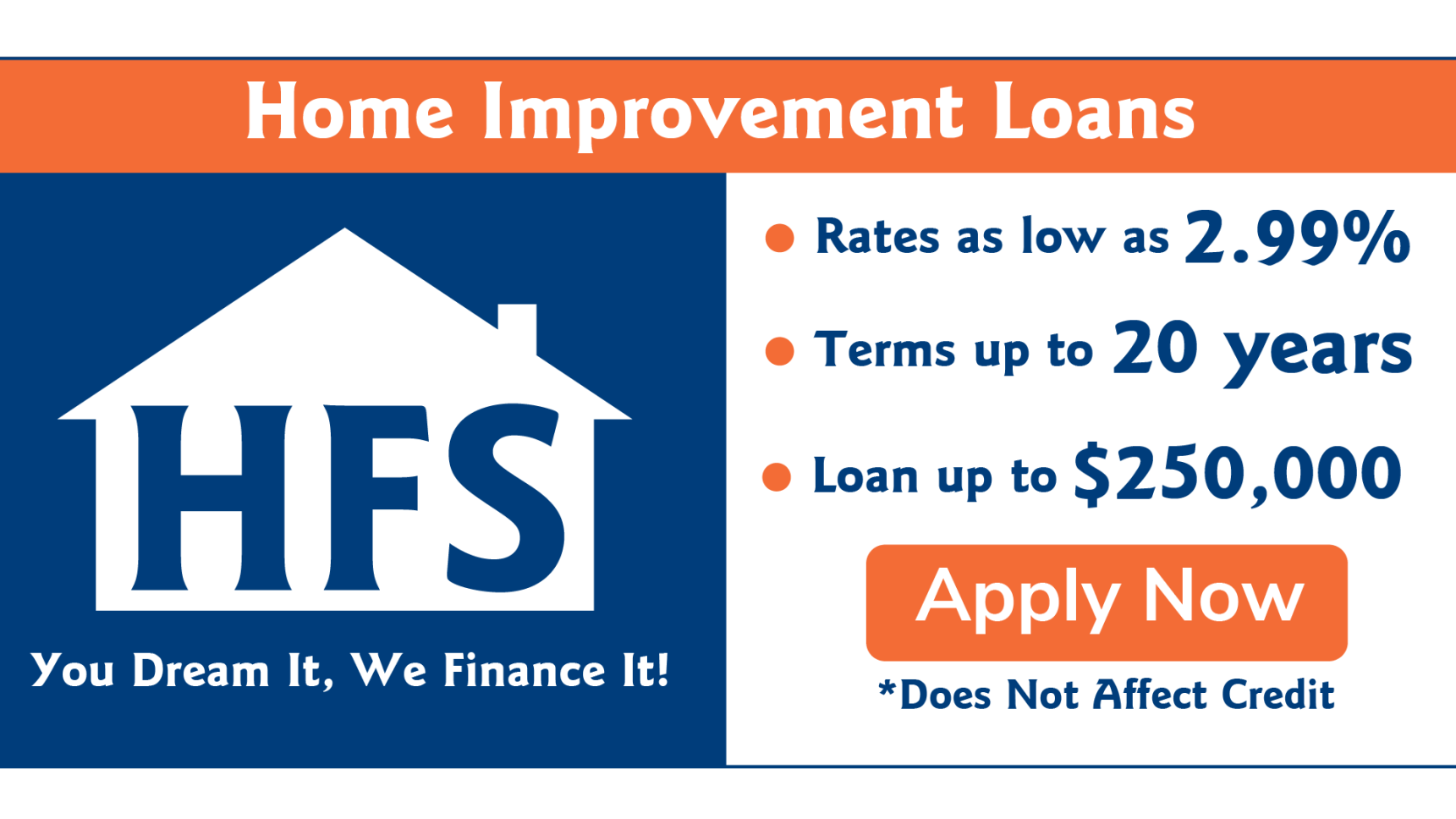

How does the Swimming Pool Kit Financing loan application and funding process through HFS work?

- Applicant receives an eligibility decision.

- Qualified applicants receive an offer (e.g., Annual Percentage Rate (APR), term options, and monthly payment amount) based on their loan amount and application information.

- Qualified applicants choosing to proceed to select an offer (e.g., APR and term).

- Qualified applicants are then asked to provide additional information to finalize their application.

- Upon loan funding, the money will be deposited into the applicant’s bank account—usually within a few days.

What are the loan amounts and terms available?

- Loan APRs start from 3.95% depending on loan amount and creditworthiness.*

- These loans are offered with no penalty for paying off early.

- *Annual Percentage Rate (APR) refers to the cost of your credit as a yearly rate. APRs, loan amounts, and loan availability may vary by state and lender. Loan offers are subject to loan approval, and for further details (including full disclosures)

Who is eligible for a loan through HFS?

U.S. Citizens and/or legal residents over the age of 18.

What is the Swimming Pool Kit Financing verification process?

Some applicants may be required to submit additional documentation or proof of income such as a W-2, 1099, or tax return in order to verify their income and eligibility.

How soon do borrowers receive their money?

Loan proceeds could be available within 1-2 business days.

Are there any fees?

Yes. Borrowers pay an “origination fee” which is a percent of the amount borrowed. The origination fee is typically between 1% and 5% of the loan amount and is deducted from the loan proceeds before the loan is funded into a borrower’s bank account*. If a monthly payment is late, the borrower may be charged a late fee.

Can a borrower pay extra on a monthly loan payment?

If the borrower chooses, they may make additional loan payments or pay off their loan early without penalty or fee.